Partition values

Short Questions

1. What are partition values?

Answer: Values that divide data into equal parts.

2. Name three types of partition values.

Answer: Quartiles, Deciles, Percentiles.

3. What is the second quartile also called?

Answer: Median.

4. How many parts do quartiles divide data into?

Answer: Four equal parts.

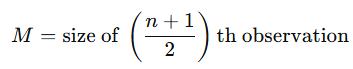

5. What is the formula for Q1 in individual data?

Answer: Size of (n+1)/4th observation.

6. How many deciles are there in a dataset?

Answer: Nine deciles.

7. What does the 50th percentile represent?

Answer: Median of the data.

8. What is the use of cumulative frequency in quartile calculation?

Answer: To find the quartile class.

9. What is the Mahalanobis distance?

Answer: A measure to compare two data sets.

10. When is Statistics Day celebrated in India?

Answer: June 29.

Long Questions

1. Explain the need for partition values in data analysis.

Answer: Partition values like median, quartiles, deciles, and percentiles are used when data has extreme values (outliers). Averages can misrepresent such data, so partition values provide a better representation by dividing data into equal parts, showing the spread and central tendency accurately.

2. What are quartiles, and how are they calculated for individual data?

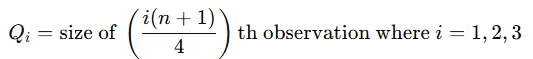

Answer: Quartiles divide data into four equal parts (Q1, Q2, Q3). For individual data, arrange data in ascending order, then use the formula Qi = size of [i(n+1)/4]th observation, where i = 1, 2, 3, to find Q1, Q2, and Q3.

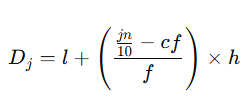

3. How are deciles useful in economics?

Answer: Deciles divide data into ten equal parts and are used to study economic inequality, poverty levels, and drought conditions. They help analyze portfolio performance in investments, providing insights into income and wealth distribution.

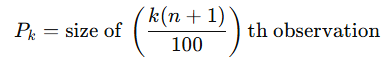

4. Describe the application of percentiles in economic data.

Answer: Percentiles divide data into 100 parts and are used to measure test scores, health indicators, household income, and wages. They help in benchmarking and comparing economic changes like wage fluctuations and inflation.

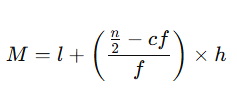

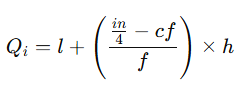

5. What is the formula for calculating Q1 in continuous data?

Answer: For continuous data, Q1 = l + [(n/4 – cf)/f] × h, where l is the lower limit of the quartile class, cf is the cumulative frequency before the quartile class, f is the frequency of the quartile class, and h is the class width.

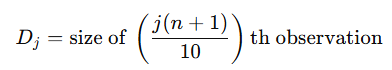

6. How do you calculate D5 for discrete data?

Answer: For discrete data, arrange observations in ascending order. Use the formula Dj = size of [j(n+1)/10]th observation, where j = 5 for D5. Locate the 5th decile by finding the corresponding observation.

7. Why is median considered a partition value?

Answer: Median divides data into two equal parts, with half the observations above and half below it. As the second quartile (Q2), it is a partition value that represents the central position in an ordered dataset.

8. What is the significance of Statistics Day in India?

Answer: Statistics Day, celebrated on June 29, honors P.C. Mahalanobis for his contributions to economic planning and statistics. It highlights the importance of statistics in data analysis and policy-making in India.

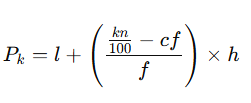

9. How are percentiles calculated for continuous data?

Answer: For continuous data, Pk = l + [(kn/100 – cf)/f] × h, where l is the lower limit of the percentile class, cf is the cumulative frequency before the class, f is the frequency, h is the class width, and k is the percentile number.

10. Explain the role of quartiles in financial data analysis.

Answer: Quartiles are used to analyze financial data like income, stock, and sales. They help study income changes due to economic factors like inflation, providing a clear picture of data distribution and trends.