Money and Credit

LET’S WORK THESE OUT (Page No. 40)

1. How does the use of money make it easier to exchange things?

Answer: The use of money makes exchange easier because money acts as a medium of exchange. In a barter system, exchange is possible only when there is a double coincidence of wants — that is, both parties must need each other’s goods or services. With money, this problem is removed. A person can sell goods or services for money, and then use that money to buy whatever they need. Thus, money eliminates the need for finding someone who wants exactly what you have and at the same time has what you want.

2. Can you think of some examples of goods / services being exchanged or wages being paid through barter?

Answer: Yes, in earlier times, people exchanged goods directly without money. For example:

- Grains and cattle were used as money in ancient India.

- A farmer might exchange wheat for a pair of shoes.

- A weaver could give cloth in return for rice.

In such cases, goods or services were directly exchanged through barter, without using money.

LET’S WORK THESE OUT (Page No. 42)

1. M. Salim wants to withdraw Rs 20,000 in cash for making payments. How would he write a cheque to withdraw money?

Answer: Salim would write a cheque in his own name for Rs. 20,000. In the cheque, he would fill his name as the “Payee,” write the amount in words and figures, and sign it. By presenting this cheque to the bank, he can withdraw Rs. 20,000 in cash from his account.

2. Tick the correct answer.

After the transaction between Salim and Prem,

(i) Salim’s balance in his bank account increases, and Prem’s balance increases.

(ii) Salim’s balance in his bank account decreases and Prem’s balance increases.

(iii) Salim’s balance in his bank account increases and Prem’s balance decreases.

Answer: (ii) Salim’s balance in his bank account decreases and Prem’s balance increases.

3. Why are demand deposits considered as money?

Answer: Demand deposits are considered as money because they can be withdrawn from the bank on demand and used for making payments through cheques. Since they are widely accepted as a means of payment along with currency, demand deposits have all the essential features of money.

LET’S WORK THESE OUT (Page No. 44)

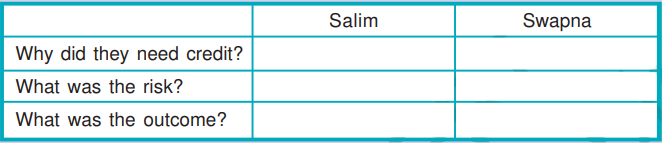

1. Fill the following table.

Answer:

| Salim | Swapna | |

|---|---|---|

| Why did they need credit? | To complete shoe production by hiring workers and buying raw materials. | To meet the expenses of cultivation of groundnut crop. |

| What was the risk? | If production was not completed on time, he might face loss and be unable to repay. | Crop failure due to pests made it difficult to repay the loan. |

| What was the outcome? | He completed production, delivered the order, made a good profit, and repaid the loan. | She fell into a debt trap, could not repay, and had to sell part of her land. |

2. Supposing Salim continues to get orders from traders. What would be his position after 6 years?

Answer: If Salim continues to get orders from traders, he will be able to regularly produce and sell shoes, earn good profits, and repay his loans on time. Over 6 years, his business will expand, his earnings will increase, and his financial position will become stronger.

3. What are the reasons that make Swapna’s situation so risky? Discuss factors – pesticides; role of moneylenders; climate.

Answer: Swapna’s situation is risky because:

- Her crop failed due to pests, even after spending money on expensive pesticides.

- She borrowed from the moneylender who charged high interest, which increased her debt.

- Farming is dependent on natural conditions like rainfall and climate. A bad season can cause heavy losses.

Thus, due to pests, high-interest loans, and uncertain climate, Swapna fell into a debt trap.

LET’S WORK THESE OUT (Page No. 45)

1. Why do lenders ask for collateral while lending?

Answer: Lenders ask for collateral because it is a security against the loan. If the borrower fails to repay the loan, the lender has the right to sell the collateral (such as land, house, livestock, deposits, etc.) to recover the money.

2. Given that a large number of people in our country are poor, does it in any way -*affect their capacity to borrow?

Answer: Yes, it affects their capacity to borrow. Poor people usually do not have collateral or proper documents, so banks are unwilling to give them loans. As a result, they are forced to depend on moneylenders and other informal sources.

3. Fill in the blanks choosing the correct option from the brackets.

While taking a loan, borrowers look for easy terms of credit. This means __________ (low/high) interest rate, __________ (easy/ tough) conditions for repayment, ________(less/more) collateral and documentation requirements.

Answer: low, easy, less

LET’S WORK THESE OUT (Page No. 46)

1. List the various sources of credit in Sonpur.

Answer: The sources of credit in Sonpur are:

- Village moneylender

- Agricultural trader

- Landowner-employer

- Commercial banks

- Cooperatives

2. Underline the various uses of credit in Sonpur in the above passages.

Answer: Uses of Credit in Sonpur:

- For cultivation (buying farm inputs like seeds, fertilisers, pesticides, etc.)

- For repaying loans after harvest by selling part of the crop

- For storing crops in cold storage and taking further loans against receipts

- For meeting daily expenses when there is no work

- For sudden expenses like illness or family functions.

3. Compare the terms of credit for the small farmer, the medium farmer and the landless agricultural worker in Sonpur.

Answer:

- Small farmer (Shyamal): Borrowed from trader at 3% per month. Had to sell crop to the trader at a low price.

- Medium farmer (Arun): Got loan from bank at 8.5% per annum, repayable after harvest. Also received facilities like loan against cold storage receipt.

- Landless worker (Rama): Took loans from landowner at 5% per month. Repaid loan by working for him but remained in debt.

4. Why will Arun have a higher income from cultivation compared to Shyamal?

Answer: Arun took a bank loan at a much lower interest rate and could sell his crop at a better price using cold storage facilities. Shyamal, on the other hand, had to sell his crop to the trader at a low price and paid very high interest. Therefore, Arun’s income is higher.

5. Can everyone in Sonpur get credit at a cheap rate? Who are the people who can?

Answer: No, everyone cannot get credit at a cheap rate. Only those who have land, property, or collateral, like medium and rich farmers, can get cheap credit from banks and cooperatives. Poor farmers and landless workers depend on moneylenders and landowners.

6. Tick the correct answer.

(i) Over the years, Rama’s debt

- will rise.

- will remain constant.

- will decline.

Answer: will rise.

(ii) Arun is one of the few people in Sonpur to take a bank loan because

- other people in the village prefer to borrow from the moneylenders.

- banks demand collateral which everyone cannot provide.

- interest rate on bank loans is same as the interest rate charged by the traders.

Answer: banks demand collateral which everyone cannot provide.

7. Talk to some people to find out the credit arrangements that exist in your area. Record your conversation. Note the differences in the terms of credit across people.

Answer: In my area, people borrow from different sources. Farmers take loans from banks and cooperatives for seeds and fertilisers. Shopkeepers borrow from traders to buy goods. Some poor people borrow from moneylenders for family needs like marriage or illness. The terms of credit are different — banks charge low interest but need documents and collateral, while moneylenders give loans quickly without documents but at very high interest rates.

LET’S WORK THESE OUT (Page No. 50)

1. What are the differences between formal and informal sources of credit?

Answer:

- Formal sources of credit include banks and cooperatives. They are supervised by the Reserve Bank of India, charge lower rates of interest, and have clear terms of credit.

- Informal sources of credit include moneylenders, traders, landowners, relatives and friends. They are not supervised by any organisation, often charge very high interest, and sometimes use unfair means to recover loans.

2. Why should credit at reasonable rates be available for all?

Answer: Credit at reasonable rates is important because it helps people to borrow easily, invest in crops, small businesses, or self-employment, and improve their income. Cheap and affordable credit reduces dependence on moneylenders and helps in the development of the country.

3. Should there be a supervisor, such as the Reserve Bank of India, that looks into the loan activities of informal lenders? Why would its task be quite difficult?

Answer: Yes, there should be supervision of informal lenders to protect poor borrowers from very high interest rates and unfair practices. However, this task would be very difficult because informal lenders are spread all over villages and towns, they work personally, and there are no records of their transactions.

4. Why do you think that the share of formal sector credit is higher for the richer households

compared to the poorer households?

Answer: The share of formal credit is higher for richer households because they have property and collateral, proper documents, and regular income. Poor households usually do not have collateral or documents, so banks hesitate to give them loans. Hence, the poor depend more on informal sources.

EXERCISES

1. In situations with high risks, credit might create further problems for the borrower. Explain.

Answer: IIf there is a crop failure or loss in business, the borrower cannot repay the loan. In such cases, the debt grows larger with interest, and the borrower may have to sell land or property. Instead of helping, credit pushes them into a debt trap.

2. How does money solve the problem of double coincidence of wants? Explain with an example of your own.

Answer: In a barter system, both parties must want each other’s goods, which is called double coincidence of wants. Money removes this problem. For example, a farmer sells wheat for money and then uses the money to buy clothes. He does not need to find a cloth seller who also wants wheat.

3. How do banks mediate between those who have surplus money and those who need money?

Answer: People deposit their surplus money in banks, which is safe and earns interest. Banks keep a small part as cash and use the rest to give loans to those who need money. Banks charge higher interest on loans than they give on deposits, and the difference is their income.

4. Look at a 10 rupee note. What is written on top? Can you explain this statement?

Answer: On a 10 rupee note, it is written: “Reserve Bank of India – Guaranteed by the Central Government.” This means the note is authorised by the government and is legal tender. No one can refuse to accept it in payment in India.

5. Why do we need to expand formal sources of credit in India?

Answer: We need to expand formal sources of credit so that more people, especially the poor and small farmers, can get loans at cheap interest rates. This reduces dependence on moneylenders who charge very high interest. Cheap credit helps in increasing income and development.

6. What is the basic idea behind the SHGs for the poor? Explain in your own words.

Answer: The basic idea is to organise poor people, especially women, into small groups who regularly save together. From these savings, members can take small loans at low interest. Later, the group can get bank loans in the name of the group. SHGs help poor people get credit without collateral and become self-reliant.

7. What are the reasons why the banks might not be willing to lend to certain borrowers?

Answer: Banks may not lend to some borrowers because:

- They do not have collateral or property.

- They cannot provide proper documents.

- Their income is irregular or uncertain.

That is why many poor people are unable to get loans from banks.

8. In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Answer: The Reserve Bank of India (RBI) supervises the functioning of banks by ensuring that they maintain a minimum cash balance out of the deposits they receive. It also monitors that banks give loans not just to profit-making businesses and traders but also to small cultivators, small borrowers, and small-scale industries. Banks have to submit information to the RBI on how much they are lending, to whom, and at what interest rate.

This supervision is necessary to ensure fairness, safety of depositors’ money, and that banks lend to all sections of society and not just the rich.

9. Analyse the role of credit for development.

Answer: Credit plays a vital role in development. It helps people meet their production and investment needs and increases their income. When credit is used in a productive way, it helps borrowers become better off, encourages business and farming, and promotes economic growth. However, if credit is used under risky conditions, it can lead to a debt trap and worsen the borrower’s situation. Therefore, easy and affordable credit is essential for overall development.

10. Manav needs a loan to set up a small business. On what basis will Manav decide

whether to borrow from the bank or the moneylender? Discuss.

Answer: Manav will decide based on the terms of credit such as the interest rate, collateral, and repayment conditions.

Banks usually offer loans at lower interest rates and with proper documentation, but they require collateral and official papers. Moneylenders, on the other hand, may lend without documents or collateral but charge a very high rate of interest. Therefore, Manav should compare these terms and prefer borrowing from the bank if he can provide the required documents and collateral, as it will be cheaper and safer.

11. In India, about 80 per cent of farmers are small farmers, who need credit for cultivation.

(a) Why might banks be unwilling to lend to small farmers?

Answer: Banks are often unwilling to lend to small farmers because they do not have proper collateral or documents required to get loans from banks.

(b) What are the other sources from which the small farmers can borrow?

Answer: Small farmers can borrow from informal sources such as moneylenders, traders, employers, relatives, and friends.

(c) Explain with an example how the terms of credit can be unfavourable for the small farmer.

Answer: In the story of Swapna, a small farmer took a loan from a moneylender for cultivation. When her crop failed, she could not repay the loan and had to sell part of her land. This shows that high interest and harsh terms of credit from informal sources can push small farmers into a debt trap.

(d) Suggest some ways by which small farmers can get cheap credit.

Answer: Small farmers can get cheap credit through banks, cooperative societies, and Self-Help Groups (SHGs), which provide loans at lower interest rates and on easy terms.

12. Fill in the blanks:

(i) Majority of the credit needs of the _______ households are met from informal sources.

(ii) ___________costs of borrowing increase the debt-burden.

(iii) __________issues currency notes on behalf of the Central Government.

(iv) Banks charge a higher interest rate on loans than what they offer on ________.

(v) ________ is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Answer:

- poor

- Higher

- Reserve Bank of India (RBI)

- deposits.

- Collateral

13. Choose the most appropriate answer.

(i) In a SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank.

(b) Members.

(c) Non-government organisation.

Answer: (b) Members

(ii) Formal sources of credit does not include

(a) Banks.

(b) Cooperatives.

(c) Employers.

Answer: (c) Employer

Leave a Reply