Financial Statements of a Company

Notes For All Chapters Accountancy Class 12

1. Financial Statements The statements which are prepared to ascertain the profit earned or loss suffered and position of assets and liabilities at a particular date are known as financial statements. These are the final product of accounting process.

A set of financial statements as per Section 2(40) of the Companies Act, 2013 include (0 Balance sheet i.e. position statement

(ii) Statement of profit and loss i.e. income statement

(iii) Notes to accounts

(iv) Cash flow statement

Section 129 of the Companies Act, 2013 requires the company to prepare its financial statements every year in prescribed form i.e. Schedule III of the Companies Act, 2013.

2. Characteristics of Financial Statements

(i) Financial statements are historical documents as they relate to past period.

(ii) Financial statements are prepared in monetary terms.

(iii) Balance sheet reveals the financial position and statement of profit and loss shows the profitability of the business organisation.

3. Nature of Financial Statements

(i) Recorded facts

(ii) Accounting conventions

(iii) Postulates

4. Objectives of Financial Statements

(i) Financial statements provide the information about the earning capacity of the business.

(ii) Financial statements provide the information about the economic resources and obligation of an enterprise.

(iii) Financial statements also provide the information about the cash flows.

(iv) Financial statements supply the information useful for judging the management’s ability to utilise the resources of business effectively.

(v) Financial statements have to report the activities of the business organisation affecting the society, which is important in its social environment.

5. Essentials of Financial Statements

(i) Accurate information

(ii) Understandability

(iii) Comparable

(iv) Verifiable

(v) Relevant

(vi) Timeliness

6. Uses and Importance of Financial Statements

(i) Report on stewardship function

(ii) Basis for fiscal policies

(iii) Basis of granting of credit

(iv) Basis for prospective investors

(v) Guide to the value of the investment already made

(vi) Aids trade associations in helping their members

7. Limitations of Financial Statements

(i) Accounting concepts and conventions involve personal judgement, so these statements are not free from bias.

(ii) Qualitative aspects of financial statements are ignored.

(iii) The present value of assets and liabilities and price-level changes are ignored.

(iv) Financial statements are historical in nature and relate to past period only.

8. Users of Financial Statements

(i) Owners including shareholders and investors

(ii) Debentureholders and financial institutions (bankers)

(iii) Creditors

(iv) Management

(v) Employees

(vi) Government, tax authorities and regulators

9. Balance Sheet

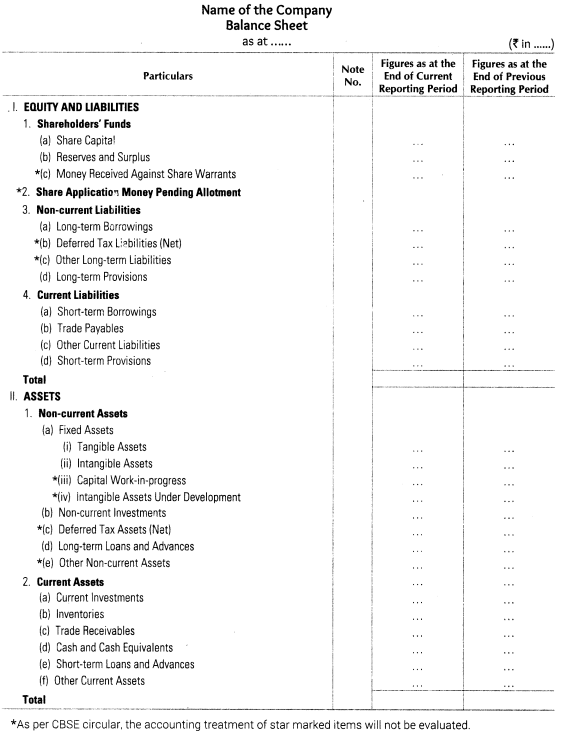

It may be defined as a statement of assets and liabilities of the company, at a particular date. It must exhibit a true and fair view of the financial position at the close of the year. It is prepared and presented in the form prescribed in Schedule III Part I of the Companies Act, 2013, and is broadly divided into two parts, (i) Equity and liabilities (ii) Assets.

Proforma of Balance Sheet (As per Revised Schedule VI)

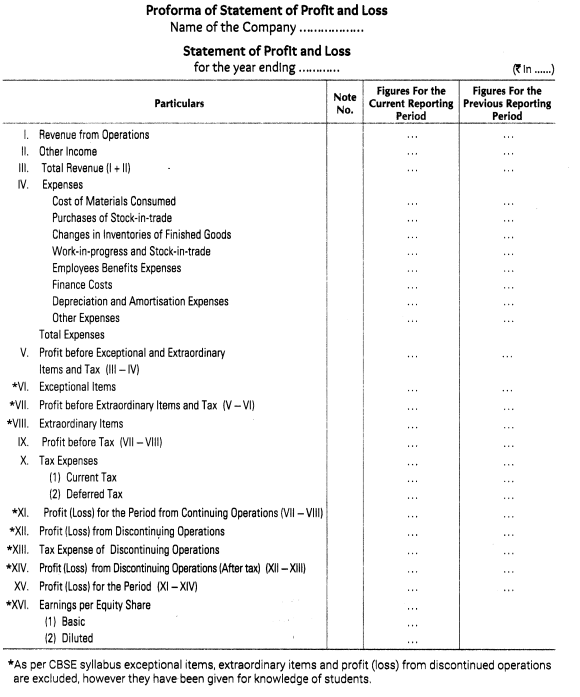

10. Statement of Profit and Loss The title of ‘profit and loss account’ is charged to statement of profit and loss. If shows the net result of business operations. Its form is prescribed in Schedule III, Part II of the Companies Act, 2013.

Leave a Reply